How Legal Funding Works

Lightning fast approval and reasonable rates

How much funding do you need?

No credit check

24 hr. funding

As seen on:

Get Funding Today in 3 Easy Steps

Uplift Legal Funding is proud to offer funding as soon as the same day you apply. Here’s how we do it:

Apply or Call

Apply online or give us a call. This step only takes a few minutes.

We Review

We contact your attorney and review your case. This only takes a few hours.

You Get Cash

After you and your lawyer review and sign our agreement, we send your funds the same day!

Get $500 to $250,000+ as soon as today

No credit check

24 hr. funding

Learn More About Legal Funding Before Applying

Legal funding may seem complicated – this guide should remove some of the mystery. If you have any questions, please give Uplift Legal Funding a call at (800) 385-3660.

Lawsuits can take a long time to settle, no matter how clear the negligence or how significant the damages.

Obtaining legal funding can help you bridge the financial gap between now and until your case is settled or won in court.

Our service is meant to help you regain financial control while you wait for your personal injury case to settle.

The funding is not a loan, because you only repay if you win the case. We get paid the same way your attorney does: only if your case is won.

If for any reason your case falls through, you keep the money we advanced you for free.

If you’re new to legal funding, here are some common questions this guide will have the answers to:

- “Does my case qualify for legal funding?”

- “Do I need to repay the advance if I lose my case?” (hint: you don’t!)

- “How does the application process work, and how fast is it?”

- “How much cash can I get against my pending settlement?”

- And more…

200+ 5 Star  Reviews

Reviews

4.9 / 5.0

5.0 / 5.0

More on Uplift Legal Funding’s Process

Obtaining legal funding from Uplift is easy. Our process is 100% paperless, hassle-free, and seamless for you and your attorney alike. Here’s the entire legal funding process from start to finish:

- Introduce Yourself – apply online or give us a call at our toll-free at (800) 385-3660. All we need from you when you apply are the basic facts of your case, as well as your attorney’s contact information. That’s all we need — your part is done after this step.

- We Review Your Case – first, we contact your law firm to learn more about your case. This step involves us getting in contact with your law firm, (with your permission) so we can learn about your case. Our underwriters will request information from your attorney based on your case type. For general personal injury loans with small-dollar values, we require very simple and straight-forward information.

- We Send You Cash – we send you cash within 24 hours of approval. We can send you the funds in a variety of ways, including but not limited to: direct deposit, overnight FedEx check, Money Gram, Western Union, and more.

So, how fast can you get legal funding? That all depends on how promptly your law firm gets us the information we need to review your case. From the moment we obtain legal funding documents, we can usually get cash in your hands in 24 hours or less.

Get $500 to $250,000+ as soon as today

No credit check

24 hr. funding

How Much Funding Will I Qualify For?

The above question is framed as “does your case qualify” instead of “do you qualify” because your personal financial history has nothing to do with your chances of getting a pre-settlement advance—it’s all about your case. The stronger the merits of your case, the higher your chances of approval – it’s that simple. While each case is unique, there are a few basic qualifications. Our case managers look at the following factors when reviewing a case.

- Liability – the opposing party (defendant) must have been responsible, and therefore liable for your injuries. To win your case, you must prove the other party was at fault. This means showing that your injuries are a result of their negligence. If a defendant rear-ended your vehicle, the liability is very clear and therefore your likelihood of approval for a pre-settlement advance is very high. For most traffic-related incidents, a police report often decides who is at fault, though police officers are sometimes wrong. For other cases, like premises liability and slip and falls, similar documentation such as an incident report or a witness statement can help establish liability.

- Insurance coverage – in most cases, legal funding companies assume that the sum of relevant insurance coverage is your maximum case value. Underwriters will ask your lawyer what the defendant’s policy limits are and, for auto accidents, whether you have UIM coverage.

- Damages – you must have sustained some type of bodily or economic damage. In order to get a cash advance on a pending settlement, you must have sustained some damages as a result of the incident. The types of damages one can sustain include bodily injuries like bone fractures or whiplash, and or economic damages such as lost wages. Legal funding companies often ask for medical records to get an idea of what treatment you’ve had and medical liens to see the treatment’s cost.

- Previous advances – While some legal funding companies won’t bite, legal funding with prior advances is an Uplift specialty. While prior advances can reduce the amount of new legal funding you qualify for, Uplift frequently buys out other funding companies’ liens. We even offer legal funding refinancing. If another lawsuit finance company is charging you high interest, we’re happy to refinance at a lower rate with no additional funding.

Why Choose Uplift

Clients love our low rates, fast funding, and attentive service.

24 Hour Funding

Get $500 to $250,000+ as soon as today

Low, Simple Rates

Simple, non-compounding rates that save you money on legal funding

No Monthly Payments

Only pay at settlement – if you lose your case, you pay back nothing

Trusted

Get the legal funding you need with the service and transparency you deserve

What Does Pre-Settlement Funding Cost?

The cost of legal funding varies from company to company, and sometimes from case to case.

Uplift provides a rate-match guarantee, which means that we will meet or beat any competitors’ funding contract terms. To honor this guarantee, we require that you provide the competing contract (call for details).

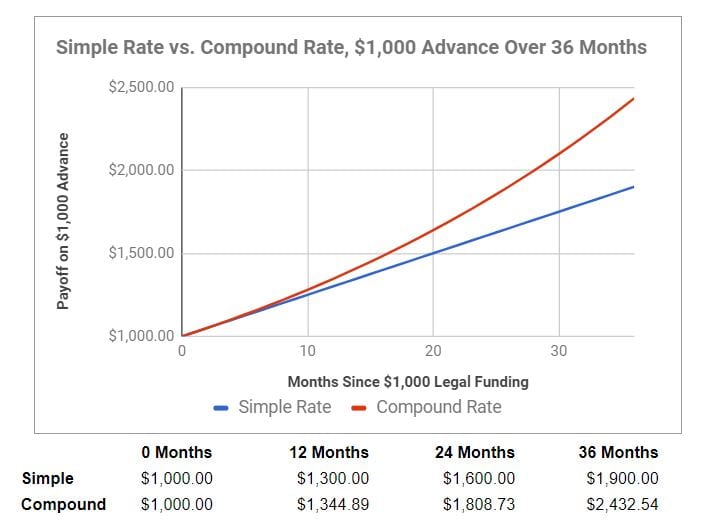

Uplift’s direct funding predominantly involves simple, non-compound interest.

Simple rates mean you never pay interest on interest, only principal.

The following chart illustrates the effect of compound vs. simple interest on $1,000 of legal funding.

Illustratively, the chart assumes 2.5% monthly simple interest on $1,000 of legal funding vs. 2.5% monthly compound interest on $1,000 of legal funding.

Get $500 to $250,000+ as soon as today

No credit check

24 hr. funding

Read More About Lawsuit Loans and Personal Injury on Our Blog

Uplift Legal Funding provides plaintiffs and legal professionals with a wealth of information about legal funding, personal injury and related topics on its blog

- Deer Park Pemex Plant Injury Lawsuit Cash AdvanceDeer Park Pemex Plant Injury Lawsuit Cash Advance Lightning fast approval and reasonable rates How much funding do you need? No credit check 24 hr. funding As seen on: Get Funding Today in 3 Easy Steps Uplift Legal Funding is proud to offer funding as soon as the same day you apply. Here’s how we… Read more: Deer Park Pemex Plant Injury Lawsuit Cash Advance

- Car Accident Trends and StatisticsCar Accident Trends and Statistics By Jared Stern Updated 04/04/2024 Key Takeaways Most Dangerous States to Drive In Based on Car Accident Fatalities The year 2023 has presented a mixed landscape regarding road safety across the United States. Overview of Traffic Fatality Risk in 2023 This color-coded map visually represents the per capita traffic fatality… Read more: Car Accident Trends and Statistics

- 2023’s Most Googled Legal Questions2023’s Most Googled Legal Questions Drawing from an extensive database of over 8,000 legal search queries, we’ve constructed a map that vividly illustrates the most searched legal questions across the United States. Below you’ll find this topical map, accompanied by intriguing statistics shedding light on America’s current legal concerns. As Uplift Legal Funding unveils its… Read more: 2023’s Most Googled Legal Questions

- What is legal transcription?What is legal transcription? This is a guest post from Ben Walker. Ben is a friend of ours at Uplift Legal Funding and the founder and CEO of Ditto Transcripts, a leading provider of transcription services across various industries. Ben founded Transcription Outsourcing in 2010, which was later rebranded to Ditto Transcripts. Legal transcription is… Read more: What is legal transcription?

- Best and Worst States for Aspiring Lawyers: An OverviewBest and Worst States for Aspiring Lawyers: An Overview A recent study commissioned by Uplift Legal Funding has pinpointed the top and bottom states for upcoming lawyers, evaluating factors like education expenses, employment opportunities, academic performance, and general well-being. Highlights Study Overview Uplift Legal Funding recently launched a comprehensive state-wise ranking for those eyeing a… Read more: Best and Worst States for Aspiring Lawyers: An Overview

Our Satisfied Customers

Brianna M

I couldn’t recommend Uplift Legal Funding more! Holly and Jared made the process so easy and pain free! All I had to do was email them and they were on it. I can go on and on about how much I recommend them! Thanks again Holly, Jared, and the whole Uplift Legal Funding team!

Nicole P

Uplift Legal Funding is true to its word about its process. It really is as easy as the three steps – apply, sign a contract, & get the money. They make sure you get the money YOU need. I recommend Uplift Legal Funding 100%.

Jacob H

Uplift Legal Funding went above and beyond to ensure I didn’t lose everything. I was able to pay my bills and avoid the imminent threat of eviction. I wholeheartedly recommend Uplift Legal Funding. You have my eternal gratitude.

These testimonials are from real, satisfied customers who posted positive reviews of Uplift Legal Funding online. They were compensated for the use of their name, likeness, and the honest reviews of our services that you see above.

Why Plaintiffs Trust Uplift Legal Funding

At Uplift Legal Funding, our number one priority is to serve plaintiffs in their time of need. We understand that waiting for a case to settle is an option everyone can afford, so we do our best to get you the cash as fast as possible. When applying with Uplift for legal funding, expect the following benefits:

- No-win no-pay legal funding from a reputable legal funding company

- Personal customer service: a dedicated specialist will guide you through our easy 3 step process.

- Some of the lowest rates in the industry: unlike other companies in our space, our rates are reasonable and fair.

- Openness and transparency: you will know what’s going on at all steps of the legal funding process, guaranteed.

- Fast cash transfer: upon approval, cash is yours within 24 hours or less.

- Fast and easy application: our legal funding process is 100% paperless and easy-it takes 5 minutes to apply.

Ready to get started? Apply online or give us a call at (800) 385-3660.

Get $500 to $250,000+ as soon as today

No credit check

24 hr. funding

Apply For Legal Funding Today

No credit check

24 hr. funding